Welcome to Course 4:

Customs Affairs

This is the fourth free comprehensive course covering the foundations of export training.

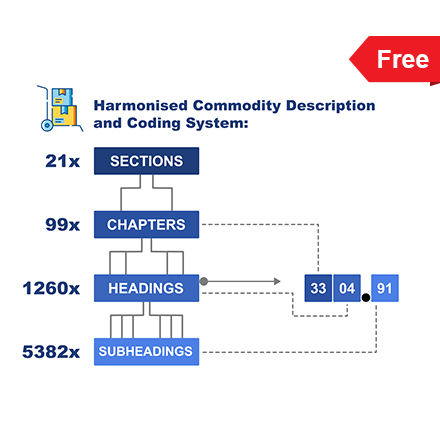

The fourth course is focused on providing learners with a comprehensive understanding of customs affairs. From the Harmonised System of Nomenclature (HS) and how it is applied through each customs process. Branching into international customs practice and customs valuation. The course rounds off with modules on the UK-SACU+M Economic Partnership Agreement and the role of the international logistics agent.

~3-4 hours |

5 Modules

Modules within this Course

There are 5 Modules within our Customs Affairs Course. Click on any module below for more information on that module and sign up for our LMS HERE to begin the course.

Learning Outcomes for Course 4: Customs Affairs

Export Foundation Training

The first course is focused on providing learners with a grasp on the global exporting and trading environment. From why countries trade and your own company’s export readiness to trading locs, trade barriers and Incoterms. After completing the full export foundation course you should have a good idea of whether or not your company is export ready, what to look out for and what to work on to ensure that you are able to export their products and/or services effectively.